Overview

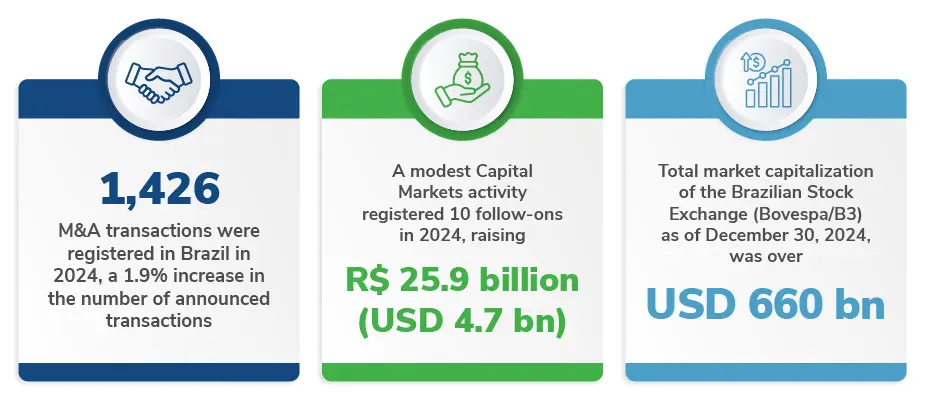

In 2024, volume in Brazil M&A activity increased to 1,426 total transactions - a 1.9% increase when compared with 2023. Most active sectors include technology (software/IT), financial / insurance, energy, healthcare and food & beverages.

Capital Markets activities in 2024 were modest, showing a second year of drop, with 10 follow-ons and BRL 25.9 billion raised (a decrease of -18.8% when compared with 2023). Since January 2022, there are no IPOs in Brazil. Ibovespa/ B3 Index register a negative 10.4% performance in 2024.

The inflation (measured by the Broad Consumer Price Index/ IPCA) accumulated 4.83% in 2024. The Central Bank of Brazil (BACEN) initiated a review (increasing) and the country's basic interest rate (SELIC) ended 2024 at 12.25%. During the year, the Brazilian Real (BRL) devaluated 27.4% against the US$.